import pandas as pd

try:

nvidia_stocks = pd.read_csv('data/stocks/nvidia_stock_2024.csv', index_col=0)

except FileNotFoundError:

url = 'https://raw.githubusercontent.com/tools4ds/DS701-Course-Notes/main/ds701_book/data/stocks/nvidia_stock_2024.csv'

nvidia_stocks = pd.read_csv(url, index_col=0)

nvidia_stocks = nvidia_stocks.sort_index()Essential Tools: Pandas

Introduction

In this lecture we discuss one of most useful Python packages for data science – Pandas.

We’ll touch on some highlights here, but to learn more, start with the Pandas Getting started tutorials

Pandas

- Pandas is a Python library for data manipulation and analysis with an emphasis on tabular data.

- It can be used to produce high quality plots and integrates nicely with other libraries that expect NumPy arrays.

- Knowledge and use of Pandas is essential as a data scientist.

The most important data structure provided by Pandas is the DataFrame implemented in the DataFrame class.

Unlike a numpy array, a DataFrame can have columns of different types.

Make it a habit that when you’re given a tabular dataset, load it into a DataFrame.

Fetching, storing and retrieving your data

We’ll work with stock data. A popular python package for this is yfinance, but there seems to be some access rate limits which make it more difficult to use.

Instead we’ll manually download a CSV file:

MANUAL DOWNLOAD FROM WALL STREET JOURNAL:

1. Go to: https://www.wsj.com/market-data/quotes/NVDA/historical-prices

2. Set date range: January 1, 2024 to December 31, 2024

3. Click "Download" button

4. Save the CSV file

5. Load in Python:It’s important to inspect the data you are working with and Pandas provides a variety of methods to do so such as .head(), .tail(), .info(), .describe(), etc.

nvidia_stocks.head()| Open | High | Low | Close | Volume | |

|---|---|---|---|---|---|

| Date | |||||

| 01/02/24 | 49.244 | 49.2950 | 47.595 | 48.168 | 4.112542e+08 |

| 01/03/24 | 47.485 | 48.1841 | 47.320 | 47.569 | 3.208962e+08 |

| 01/04/24 | 47.767 | 48.5000 | 47.508 | 47.998 | 3.065349e+08 |

| 01/05/24 | 48.462 | 49.5470 | 48.306 | 49.097 | 4.150393e+08 |

| 01/08/24 | 49.512 | 52.2750 | 49.479 | 52.253 | 6.425099e+08 |

Notice how each row has a label and each column has a label.

A DataFrame is a python object that has many associated methods to explore and manipulate the data.

The method .info() gives you a description of the dataframe.

nvidia_stocks.info()<class 'pandas.core.frame.DataFrame'>

Index: 252 entries, 01/02/24 to 12/31/24

Data columns (total 5 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Open 252 non-null float64

1 High 252 non-null float64

2 Low 252 non-null float64

3 Close 252 non-null float64

4 Volume 252 non-null float64

dtypes: float64(5)

memory usage: 11.8+ KBThe method .describe() gives you summary statistics of the dataframe.

nvidia_stocks.describe()| Open | High | Low | Close | Volume | |

|---|---|---|---|---|---|

| count | 252.000000 | 252.000000 | 252.000000 | 252.000000 | 2.520000e+02 |

| mean | 107.899121 | 109.852719 | 105.631198 | 107.825438 | 3.773571e+08 |

| std | 27.145281 | 27.437677 | 26.575767 | 26.957320 | 1.618595e+08 |

| min | 47.485000 | 48.184100 | 47.320000 | 47.569000 | 1.051570e+08 |

| 25% | 87.740500 | 89.479750 | 86.128550 | 87.751500 | 2.498443e+08 |

| 50% | 115.950000 | 117.090000 | 111.791500 | 115.295000 | 3.508633e+08 |

| 75% | 130.282500 | 133.542500 | 128.235000 | 130.462500 | 4.752442e+08 |

| max | 149.350000 | 152.890000 | 146.260000 | 148.880000 | 1.142269e+09 |

Writing/Reading to/from a .csv file

Pandas can read and write dataframes with many file formats such as .csv, .json, .parquet, .xlsx, .html, SQL, etc.

Here we write the dataframe to a .csv file.

nvidia_stocks.to_csv('nvidia_data.csv')We can escape a shell command using the ! operator to see the top of the file.

!head nvidia_data.csvDate,Open,High,Low,Close,Volume

01/02/24,49.244,49.295,47.595,48.168,411254215.887458

01/03/24,47.485,48.1841,47.32,47.569,320896186.791038

01/04/24,47.767,48.5,47.508,47.998,306534876.934651

01/05/24,48.462,49.547,48.306,49.097,415039295.849607

01/08/24,49.512,52.275,49.479,52.253,642509873.574901

01/09/24,52.401,54.325,51.69,53.14,773100072.268999

01/10/24,53.616,54.6,53.489,54.35,533795774.662042

01/11/24,54.999,55.346,53.56,54.822,596758784.032412

01/12/24,54.62,54.97,54.3301,54.71,352993586.470064And of course we can likewise read a .csv file into a dataframe. This is probably the most common way you will get data into Pandas.

df = pd.read_csv('nvidia_data.csv')

df.head()| Date | Open | High | Low | Close | Volume | |

|---|---|---|---|---|---|---|

| 0 | 01/02/24 | 49.244 | 49.2950 | 47.595 | 48.168 | 4.112542e+08 |

| 1 | 01/03/24 | 47.485 | 48.1841 | 47.320 | 47.569 | 3.208962e+08 |

| 2 | 01/04/24 | 47.767 | 48.5000 | 47.508 | 47.998 | 3.065349e+08 |

| 3 | 01/05/24 | 48.462 | 49.5470 | 48.306 | 49.097 | 4.150393e+08 |

| 4 | 01/08/24 | 49.512 | 52.2750 | 49.479 | 52.253 | 6.425099e+08 |

But be careful, the index column is not automatically set.

df.info()<class 'pandas.core.frame.DataFrame'>

RangeIndex: 252 entries, 0 to 251

Data columns (total 6 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Date 252 non-null object

1 Open 252 non-null float64

2 High 252 non-null float64

3 Low 252 non-null float64

4 Close 252 non-null float64

5 Volume 252 non-null float64

dtypes: float64(5), object(1)

memory usage: 11.9+ KBNote the index description.

To set the index column, we can use the index_col parameter.

df = pd.read_csv('nvidia_data.csv', index_col=0)

df.info()<class 'pandas.core.frame.DataFrame'>

Index: 252 entries, 01/02/24 to 12/31/24

Data columns (total 5 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Open 252 non-null float64

1 High 252 non-null float64

2 Low 252 non-null float64

3 Close 252 non-null float64

4 Volume 252 non-null float64

dtypes: float64(5)

memory usage: 11.8+ KBWorking with data columns

In general, we’ll typically describe the rows in the dataframe as items (or observations or data samples) and the columns as features.

df.columnsIndex(['Open', 'High', 'Low', 'Close', 'Volume'], dtype='object')Pandas allows you to reference a column similar to a python dictionary key, using column names in square brackets.

df['Open']Date

01/02/24 49.244

01/03/24 47.485

01/04/24 47.767

01/05/24 48.462

01/08/24 49.512

...

12/24/24 140.000

12/26/24 139.700

12/27/24 138.550

12/30/24 134.830

12/31/24 138.030

Name: Open, Length: 252, dtype: float64Note that this returns a Series object, the other fundamental data structure in Pandas.

type(df['Open'])pandas.core.series.SeriesAlso note that Series is indexed in this case by dates rather than simple integers.

Pandas also allows you to refer to columns using an object attribute syntax.

Note that the column name cannot include a space in this case.

df.OpenDate

01/02/24 49.244

01/03/24 47.485

01/04/24 47.767

01/05/24 48.462

01/08/24 49.512

...

12/24/24 140.000

12/26/24 139.700

12/27/24 138.550

12/30/24 134.830

12/31/24 138.030

Name: Open, Length: 252, dtype: float64You can select a list of columns:

df[['Open', 'Close']].head()| Open | Close | |

|---|---|---|

| Date | ||

| 01/02/24 | 49.244 | 48.168 |

| 01/03/24 | 47.485 | 47.569 |

| 01/04/24 | 47.767 | 47.998 |

| 01/05/24 | 48.462 | 49.097 |

| 01/08/24 | 49.512 | 52.253 |

Which is just another dataframe, which is why we can chain the .head() method.

type(df[['Open', 'Close']])pandas.core.frame.DataFrameChanging column names is as simple as assigning to the .columns property.

Let’s adjust the column names to remove spaces.

new_column_names = [x.lower().replace(' ', '_') for x in df.columns]

df.columns = new_column_names

df.info()<class 'pandas.core.frame.DataFrame'>

Index: 252 entries, 01/02/24 to 12/31/24

Data columns (total 5 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 open 252 non-null float64

1 high 252 non-null float64

2 low 252 non-null float64

3 close 252 non-null float64

4 volume 252 non-null float64

dtypes: float64(5)

memory usage: 19.9+ KBObserve that we first created a list of column names without spaces using list comprehension. This is the pythonic way to generate a new list.

Now all columns can be accessed using the dot notation.

A sampling of DataFrame methods.

There are many useful methods in the DataFrame object. It is important to familiarize yourself with these methods.

The following methods calculate the mean, standard deviation, and median of the specified numeric columns.

df.mean()open 1.078991e+02

high 1.098527e+02

low 1.056312e+02

close 1.078254e+02

volume 3.773571e+08

dtype: float64or we can give a list of columns to the Dataframe object:

df[['open', 'close', 'volume']].mean()open 1.078991e+02

close 1.078254e+02

volume 3.773571e+08

dtype: float64df.std()open 2.714528e+01

high 2.743768e+01

low 2.657577e+01

close 2.695732e+01

volume 1.618595e+08

dtype: float64df.median()open 1.159500e+02

high 1.170900e+02

low 1.117915e+02

close 1.152950e+02

volume 3.508633e+08

dtype: float64Or apply the method to a single column:

df.open.mean()np.float64(107.89912063492064)df.high.mean()np.float64(109.85271904761905)Plotting methods

Pandas also wraps matplotlib and provides a variety of easy-to-use plotting functions directly from the dataframe object.

These are your “first look” functions and useful in exploratory data analysis.

Later, we will use more specialized graphics packages to create more sophisticated visualizations.

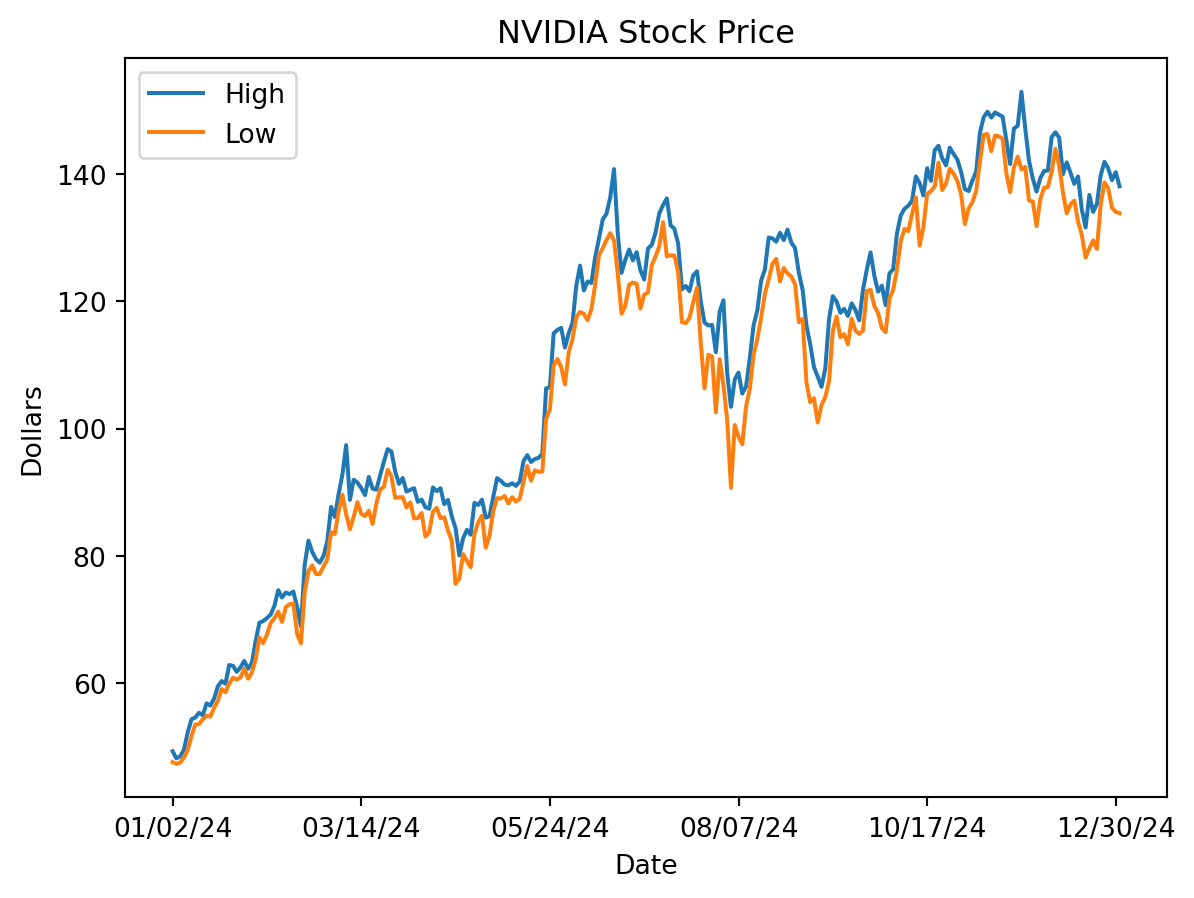

import matplotlib.pyplot as plt

df.high.plot(label='High')

df.low.plot(label='Low')

plt.title('NVIDIA Stock Price')

plt.ylabel('Dollars')

plt.legend(loc='best')

plt.show()

Or a histogram on the adjusted closing price.

df.close.hist()

plt.xlabel('Closing Price')

plt.ylabel('Dollars')

plt.title('NVIDIA Stock Price')

plt.show()

Accessing rows of the DataFrame

So far we’ve seen how to access a column of the DataFrame. To access a row we use different syntax.

To access a row by its index label, use the .loc() method (‘location’).

df.loc['01/02/24']open 4.924400e+01

high 4.929500e+01

low 4.759500e+01

close 4.816800e+01

volume 4.112542e+08

Name: 01/02/24, dtype: float64As a tangent, we can use the .apply() method to format the output.

df.loc['01/02/24'].apply(lambda x: '{:,.2f}'.format(x) if isinstance(x, (int, float)) else x)open 49.24

high 49.30

low 47.59

close 48.17

volume 411,254,215.89

Name: 01/02/24, dtype: objectTo access a row by its index number (i.e., like an array index), use .iloc() (‘integer location’)

df.iloc[0, :]open 4.924400e+01

high 4.929500e+01

low 4.759500e+01

close 4.816800e+01

volume 4.112542e+08

Name: 01/02/24, dtype: float64and similarly formatted:

df.iloc[0, :].apply(lambda x: '{:,.2f}'.format(x) if isinstance(x, (int, float)) else x)open 49.24

high 49.30

low 47.59

close 48.17

volume 411,254,215.89

Name: 01/02/24, dtype: objectTo iterate over the rows you can use .iterrows().

num_positive_days = 0

for idx, row in df.iterrows():

if row.close > row.open:

num_positive_days += 1

print(f"The total number of positive-gain days is {num_positive_days} out of {len(df)} days or as percentage {num_positive_days/len(df):.2%}")The total number of positive-gain days is 134 out of 252 days or as percentage 53.17%This is only capturing the intraday gain/loss, not the cumulative inter-day gain/loss.

Filtering

It is easy to select rows from the data.

All the operations below return a new Series or DataFrame, which itself can be treated the same way as all Series and DataFrames we have seen so far.

tmp_high = df.high > 100

tmp_high.tail()Date

12/24/24 True

12/26/24 True

12/27/24 True

12/30/24 True

12/31/24 True

Name: high, dtype: boolSumming a Boolean array is the same as counting the number of True values.

sum(tmp_high)153Now, let’s select only the rows of df that correspond to tmp_high.

We can pass a series to the dataframe to select rows.

df[tmp_high]| open | high | low | close | volume | |

|---|---|---|---|---|---|

| Date | |||||

| 05/23/24 | 102.028 | 106.3200 | 101.520 | 103.799 | 8.350653e+08 |

| 05/24/24 | 104.449 | 106.4750 | 103.000 | 106.469 | 4.294937e+08 |

| 05/28/24 | 110.244 | 114.9390 | 109.883 | 113.901 | 6.527280e+08 |

| 05/29/24 | 113.050 | 115.4920 | 110.901 | 114.825 | 5.574419e+08 |

| 05/30/24 | 114.650 | 115.8192 | 109.663 | 110.500 | 4.873503e+08 |

| ... | ... | ... | ... | ... | ... |

| 12/24/24 | 140.000 | 141.9000 | 138.650 | 140.220 | 1.051570e+08 |

| 12/26/24 | 139.700 | 140.8500 | 137.730 | 139.930 | 1.165191e+08 |

| 12/27/24 | 138.550 | 139.0200 | 134.710 | 137.010 | 1.705826e+08 |

| 12/30/24 | 134.830 | 140.2700 | 134.020 | 137.490 | 1.677347e+08 |

| 12/31/24 | 138.030 | 138.0700 | 133.830 | 134.290 | 1.556592e+08 |

153 rows × 5 columns

Putting it all together, we can count the number of positive days without iterating over the rows.

positive_days = df[df.close > df.open]

print(f"Total number of positive-gain days is {len(positive_days)}")

positive_days.head()Total number of positive-gain days is 134| open | high | low | close | volume | |

|---|---|---|---|---|---|

| Date | |||||

| 01/03/24 | 47.485 | 48.1841 | 47.320 | 47.569 | 3.208962e+08 |

| 01/04/24 | 47.767 | 48.5000 | 47.508 | 47.998 | 3.065349e+08 |

| 01/05/24 | 48.462 | 49.5470 | 48.306 | 49.097 | 4.150393e+08 |

| 01/08/24 | 49.512 | 52.2750 | 49.479 | 52.253 | 6.425099e+08 |

| 01/09/24 | 52.401 | 54.3250 | 51.690 | 53.140 | 7.731001e+08 |

Or count the number of days with a gain of more than $2.

very_positive_days = df[(df.close - df.open) > 2]

print(f"Total number of days with gain > $2 is {len(very_positive_days)}")

very_positive_days.head()Total number of days with gain > $2 is 51| open | high | low | close | volume | |

|---|---|---|---|---|---|

| Date | |||||

| 01/08/24 | 49.512 | 52.275 | 49.479 | 52.253 | 6.425099e+08 |

| 02/02/24 | 63.974 | 66.600 | 63.690 | 66.160 | 4.765777e+08 |

| 02/22/24 | 75.025 | 78.575 | 74.220 | 78.538 | 8.650997e+08 |

| 03/01/24 | 80.000 | 82.300 | 79.435 | 82.279 | 4.791351e+08 |

| 03/07/24 | 90.158 | 92.767 | 89.602 | 92.669 | 6.081191e+08 |

Note that this doesn’t the explain the total gain for the year. Why?

Creating new columns

To create a new column, simply assign values to it. The column name is similar to a key in a dictionary.

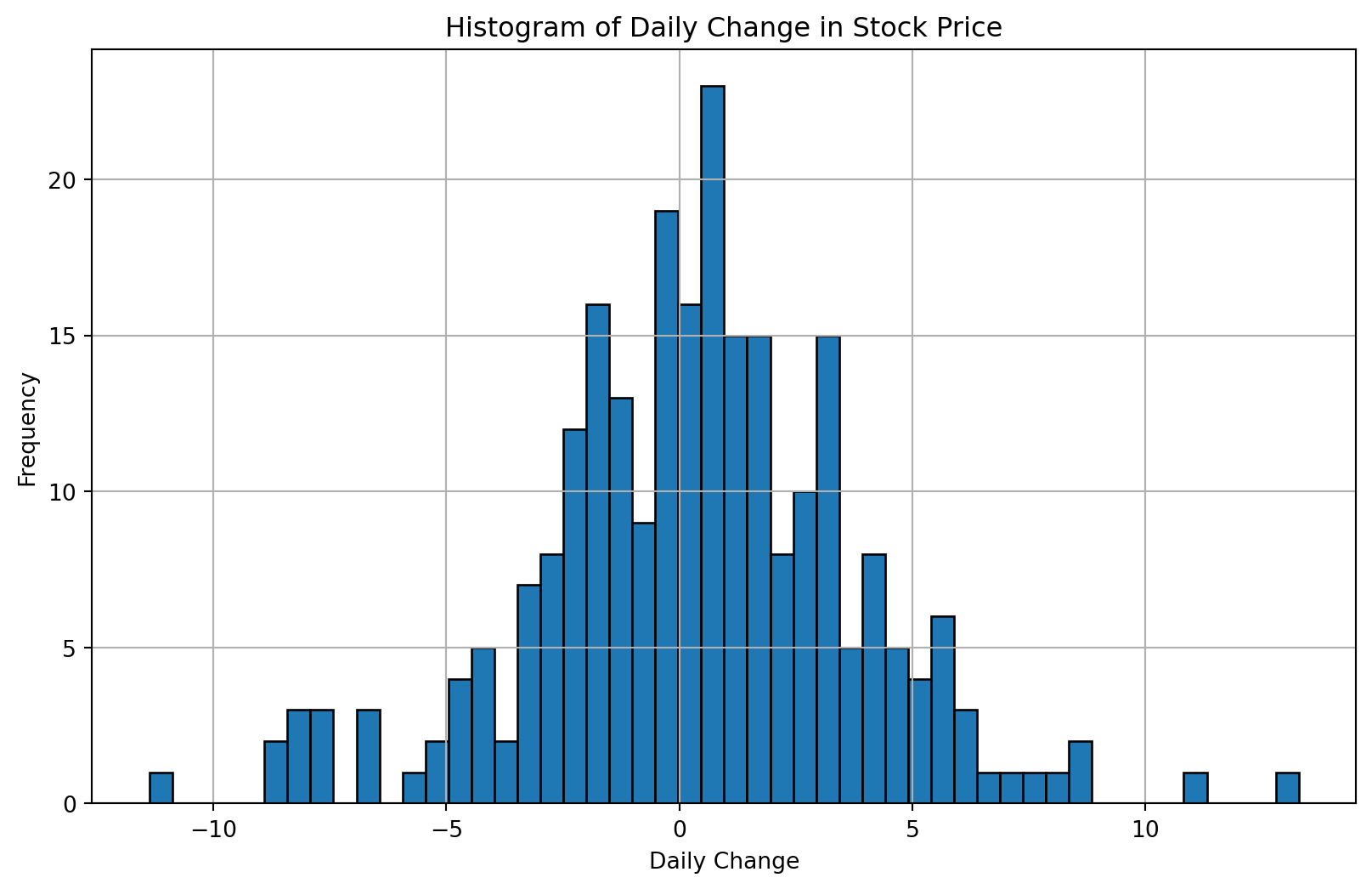

Let’s look at the daily change in closing price.

# Calculate the daily change in closing price

df['daily_change'] = df['close'].diff()

# Create the cumulative profit column

df['cum_profit'] = df['daily_change'].cumsum()

# Display the first few rows to verify the new column

print(df[['close', 'daily_change', 'cum_profit']].head()) close daily_change cum_profit

Date

01/02/24 48.168 NaN NaN

01/03/24 47.569 -0.599 -0.599

01/04/24 47.998 0.429 -0.170

01/05/24 49.097 1.099 0.929

01/08/24 52.253 3.156 4.085It is convenient that .diff() by default is the difference between the current and previous row.

Let’s look at the histogram of the daily change in stock price.

# Plot histogram of daily_change

plt.figure(figsize=(10, 6))

df['daily_change'].hist(bins=50, edgecolor='black')

plt.title('Histogram of Daily Change in Stock Price')

plt.xlabel('Daily Change')

plt.ylabel('Frequency')

plt.show()

Let’s give each row a gain value as a categorical variable.

for idx, row in df.iterrows():

if row.daily_change < 0:

df.loc[idx,'cat_gain']='negative'

elif row.daily_change < 1:

df.loc[idx,'cat_gain']='small_gain'

elif row.daily_change < 2:

df.loc[idx,'cat_gain']='medium_gain'

elif row.daily_change >= 2:

df.loc[idx,'cat_gain']='large_gain'

df.head()| open | high | low | close | volume | daily_change | cum_profit | cat_gain | |

|---|---|---|---|---|---|---|---|---|

| Date | ||||||||

| 01/02/24 | 49.244 | 49.2950 | 47.595 | 48.168 | 4.112542e+08 | NaN | NaN | NaN |

| 01/03/24 | 47.485 | 48.1841 | 47.320 | 47.569 | 3.208962e+08 | -0.599 | -0.599 | negative |

| 01/04/24 | 47.767 | 48.5000 | 47.508 | 47.998 | 3.065349e+08 | 0.429 | -0.170 | small_gain |

| 01/05/24 | 48.462 | 49.5470 | 48.306 | 49.097 | 4.150393e+08 | 1.099 | 0.929 | medium_gain |

| 01/08/24 | 49.512 | 52.2750 | 49.479 | 52.253 | 6.425099e+08 | 3.156 | 4.085 | large_gain |

Here is another, more “functional”, way to accomplish the same thing.

First, let’s drop the gain column so we can start fresh.

df.drop('cat_gain', axis=1, inplace=True)

df.head()| open | high | low | close | volume | daily_change | cum_profit | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 01/02/24 | 49.244 | 49.2950 | 47.595 | 48.168 | 4.112542e+08 | NaN | NaN |

| 01/03/24 | 47.485 | 48.1841 | 47.320 | 47.569 | 3.208962e+08 | -0.599 | -0.599 |

| 01/04/24 | 47.767 | 48.5000 | 47.508 | 47.998 | 3.065349e+08 | 0.429 | -0.170 |

| 01/05/24 | 48.462 | 49.5470 | 48.306 | 49.097 | 4.150393e+08 | 1.099 | 0.929 |

| 01/08/24 | 49.512 | 52.2750 | 49.479 | 52.253 | 6.425099e+08 | 3.156 | 4.085 |

Define a function that classifies rows, and apply it to each row.

def namerow(row):

if row.daily_change < 0:

return 'negative'

elif row.daily_change < 1:

return 'small_gain'

elif row.daily_change < 2:

return 'medium_gain'

elif row.daily_change >= 2:

return 'large_gain'

df['cat_gain'] = df.apply(namerow, axis=1)

df.head()| open | high | low | close | volume | daily_change | cum_profit | cat_gain | |

|---|---|---|---|---|---|---|---|---|

| Date | ||||||||

| 01/02/24 | 49.244 | 49.2950 | 47.595 | 48.168 | 4.112542e+08 | NaN | NaN | None |

| 01/03/24 | 47.485 | 48.1841 | 47.320 | 47.569 | 3.208962e+08 | -0.599 | -0.599 | negative |

| 01/04/24 | 47.767 | 48.5000 | 47.508 | 47.998 | 3.065349e+08 | 0.429 | -0.170 | small_gain |

| 01/05/24 | 48.462 | 49.5470 | 48.306 | 49.097 | 4.150393e+08 | 1.099 | 0.929 | medium_gain |

| 01/08/24 | 49.512 | 52.2750 | 49.479 | 52.253 | 6.425099e+08 | 3.156 | 4.085 | large_gain |

Understanding pandas DataFrame.groupby()

Introduction

The groupby() function is one of the most powerful tools in pandas for data analysis. It implements the “split-apply-combine” pattern:

- Split your data into groups based on some criteria

- Apply a function to each group independently

- Combine the results back into a data structure

Think of it like organizing a deck of cards by suit, then counting how many cards are in each suit, then presenting those counts in a summary table.

Basic Concept

Imagine you have a dataset of student grades:

import pandas as pd

data = {

'student': ['Alice', 'Bob', 'Alice', 'Bob', 'Charlie', 'Charlie'],

'subject': ['Math', 'Math', 'English', 'English', 'Math', 'English'],

'score': [85, 78, 92, 88, 95, 90]

}

df = pd.DataFrame(data)

print(df) student subject score

0 Alice Math 85

1 Bob Math 78

2 Alice English 92

3 Bob English 88

4 Charlie Math 95

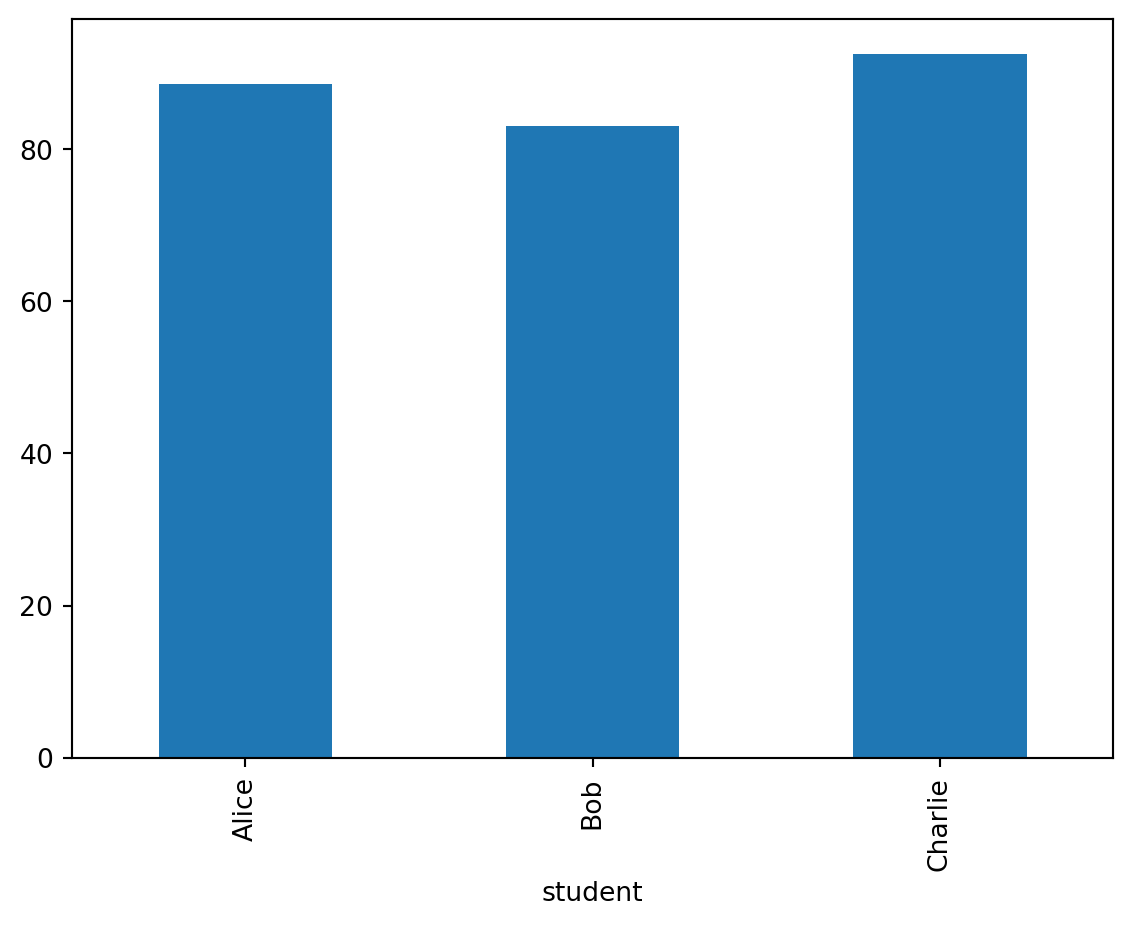

5 Charlie English 90Example 1: Simple Grouping

Let’s find the average score for each student:

# Group by student and calculate mean

result = df.groupby('student')['score'].mean()

print(result)student

Alice 88.5

Bob 83.0

Charlie 92.5

Name: score, dtype: float64What happened?

- pandas split the data into 3 groups (one per student)

- Applied the

mean()function to each group’s scores - Combined the results into a Series indexed by the student names

Example 2: Multiple Aggregations

You can apply multiple functions at once:

# Multiple aggregations

result = df.groupby('student')['score'].agg(['mean', 'min', 'max', 'count'])

print(result) mean min max count

student

Alice 88.5 85 92 2

Bob 83.0 78 88 2

Charlie 92.5 90 95 2where the list in the agg() method is both a list of functions to apply to the column and a list of names for the columns in the resulting DataFrame.

What happened?

- pandas split the data into 3 groups (one per student)

- Applied the

mean(),min(),max(), andcount()functions to each group’s scores - Combined the results into a DataFrame indexed by the student names with the column names being the functions applied to the scores.

Example 3: Grouping by Multiple Columns

What if we want to see scores grouped by both student AND subject?

# Group by multiple columns

result = df.groupby(['student', 'subject'])['score'].mean()

print(result)student subject

Alice English 92.0

Math 85.0

Bob English 88.0

Math 78.0

Charlie English 90.0

Math 95.0

Name: score, dtype: float64This creates a hierarchical index (MultiIndex) with two levels.

Example 4: Aggregating Multiple Columns

Let’s add more data:

data = {

'student': ['Alice', 'Bob', 'Alice', 'Bob', 'Charlie', 'Charlie'],

'subject': ['Math', 'Math', 'English', 'English', 'Math', 'English'],

'score': [85, 78, 92, 88, 95, 90],

'hours_studied': [5, 3, 6, 4, 7, 5]

}

df = pd.DataFrame(data)

# Group by student and get mean of all numeric columns

result = df.groupby('student')[['score', 'hours_studied']].mean()

print(result) score hours_studied

student

Alice 88.5 5.5

Bob 83.0 3.5

Charlie 92.5 6.0Example 5: Different Aggregations for Different Columns

You can apply different functions to different columns:

# Different aggregations for different columns

result = df.groupby('student').agg({

'score': ['mean', 'max'],

'hours_studied': 'sum'

})

print(result) score hours_studied

mean max sum

student

Alice 88.5 92 11

Bob 83.0 88 7

Charlie 92.5 95 12Example 6: Using Custom Functions

You can define your own aggregation functions:

# Custom function: range (max - min)

def score_range(x):

return x.max() - x.min()

result = df.groupby('student')['score'].agg([

'mean',

('range', score_range)

])

print(result) mean range

student

Alice 88.5 7

Bob 83.0 10

Charlie 92.5 5where the argument ('range', score_range) is a tuple with the name of the column in the resulting DataFrame and the function to apply to the column.

What happened?

- pandas split the data into 3 groups (one per student)

- Applied the

mean()function to the scores column - Applied the

score_range()function to the scores column and named the columnrangein the resulting DataFrame - Combined the results into a DataFrame indexed by the student names with the column names being the functions applied to the scores.

Example 7: Filtering Groups

You can filter out entire groups based on conditions:

# Only keep students with average score above 85

result = df.groupby('student').filter(lambda x: x['score'].mean() > 85)

print(result) student subject score hours_studied

0 Alice Math 85 5

2 Alice English 92 6

4 Charlie Math 95 7

5 Charlie English 90 5Example 8: Transform - Keeping Original Shape

Sometimes you want to add group statistics to your original dataframe:

# Add a column with each student's average score

df['student_avg'] = df.groupby('student')['score'].transform('mean')

print(df) student subject score hours_studied student_avg

0 Alice Math 85 5 88.5

1 Bob Math 78 3 83.0

2 Alice English 92 6 88.5

3 Bob English 88 4 83.0

4 Charlie Math 95 7 92.5

5 Charlie English 90 5 92.5Notice how transform() returns a Series with the same length as the original DataFrame, broadcasting the group statistic to all rows in that group.

Example 9: Apply - Maximum Flexibility

The apply() method gives you complete control and can return different shapes:

# Use apply() to get multiple statistics per group

def analyze_student(group):

return pd.Series({

'avg_score': group['score'].mean(),

'score_range': group['score'].max() - group['score'].min(),

'total_hours': group['hours_studied'].sum(),

'efficiency': group['score'].mean() / group['hours_studied'].mean()

})

result = df.groupby('student').apply(analyze_student, include_groups=False)

print(result) avg_score score_range total_hours efficiency

student

Alice 88.5 7.0 11.0 16.090909

Bob 83.0 10.0 7.0 23.714286

Charlie 92.5 5.0 12.0 15.416667Note: Unlike transform() which must return the same shape as the input, apply() can return aggregated results of any shape.

Example 10: Iterating Over Groups

Sometimes you need to process each group separately:

# Iterate over groups

for name, group in df.groupby('student'):

print(f"\n{name}'s records:")

print(group)

Alice's records:

student subject score hours_studied student_avg

0 Alice Math 85 5 88.5

2 Alice English 92 6 88.5

Bob's records:

student subject score hours_studied student_avg

1 Bob Math 78 3 83.0

3 Bob English 88 4 83.0

Charlie's records:

student subject score hours_studied student_avg

4 Charlie Math 95 7 92.5

5 Charlie English 90 5 92.5Common Aggregation Functions

Here are the most commonly used aggregation functions:

count()- Number of non-null valuessum()- Sum of valuesmean()- Average of valuesmedian()- Median valuemin()- Minimum valuemax()- Maximum valuestd()- Standard deviationvar()- Variancefirst()- First value in grouplast()- Last value in groupsize()- Number of rows (including NaN)

Example 11: (Synthetic) Sales Data Analysis

# Sample sales data

sales_data = {

'date': pd.date_range('2024-01-01', periods=12, freq='ME'),

'region': ['North', 'South', 'North', 'South', 'North', 'South',

'North', 'South', 'North', 'South', 'North', 'South'],

'product': ['A', 'A', 'B', 'B', 'A', 'A', 'B', 'B', 'A', 'A', 'B', 'B'],

'sales': [100, 150, 200, 175, 110, 165, 210, 180, 120, 170, 220, 190],

'units': [10, 15, 20, 17, 11, 16, 21, 18, 12, 17, 22, 19]

}

sales_df = pd.DataFrame(sales_data)

print(sales_df)

# Comprehensive analysis by region

analysis = sales_df.groupby('region').agg({

'sales': ['sum', 'mean', 'max'],

'units': 'sum',

'product': 'count' # Count of transactions

})

print("\nAnalysis:")

print(analysis) date region product sales units

0 2024-01-31 North A 100 10

1 2024-02-29 South A 150 15

2 2024-03-31 North B 200 20

3 2024-04-30 South B 175 17

4 2024-05-31 North A 110 11

5 2024-06-30 South A 165 16

6 2024-07-31 North B 210 21

7 2024-08-31 South B 180 18

8 2024-09-30 North A 120 12

9 2024-10-31 South A 170 17

10 2024-11-30 North B 220 22

11 2024-12-31 South B 190 19

Analysis:

sales units product

sum mean max sum count

region

North 960 160.000000 220 96 6

South 1030 171.666667 190 102 6Tips and Best Practices

Reset Index: After groupby operations, you often want to reset the index:

result = df.groupby('student')['score'].mean().reset_index() print("\nResult:") print(result) result2 = df.groupby('student')['score'].mean().reset_index() print("\nResult2:") print(result2)Result: student score 0 Alice 88.5 1 Bob 83.0 2 Charlie 92.5 Result2: student score 0 Alice 88.5 1 Bob 83.0 2 Charlie 92.5Naming Aggregations: Give your aggregated columns meaningful names:

result = df.groupby('student').agg( avg_score=('score', 'mean'), total_hours=('hours_studied', 'sum') )Performance: For large datasets, groupby is highly optimized in pandas. It’s usually faster than writing loops.

Missing Values: By default, groupby excludes NaN values from groups. Use

dropna=Falseto include them:df.groupby('student', dropna=False)['score'].mean()student Alice 88.5 Bob 83.0 Charlie 92.5 Name: score, dtype: float64Sort Results: Control sorting with

sort=True/False:df.groupby('student', sort=False)['score'].mean() # Preserve original orderstudent Alice 88.5 Bob 83.0 Charlie 92.5 Name: score, dtype: float64

Visualizing Grouped Data

Groupby works seamlessly with pandas plotting:

# Create a bar chart of average scores by student

df.groupby('student')['score'].mean().plot(kind='bar')

groupby() Summary

The groupby() function is essential for:

- Calculating statistics by category

- Finding patterns in subgroups

- Data aggregation and summarization

- Feature engineering (with transform)

- Comparative analysis

Master the split-apply-combine pattern, and you’ll unlock powerful data analysis capabilities!

groupby() Practice Exercise

Try this on your own:

# Create sample data

practice_data = {

'department': ['Sales', 'Sales', 'IT', 'IT', 'HR', 'HR', 'Sales', 'IT'],

'employee': ['John', 'Jane', 'Bob', 'Alice', 'Tom', 'Mary', 'Steve', 'Linda'],

'salary': [50000, 55000, 65000, 70000, 48000, 52000, 53000, 68000],

'experience': [2, 3, 5, 7, 1, 4, 3, 6]

}

practice_df = pd.DataFrame(practice_data)

# Try to answer:

# 1. What's the average salary by department?

# 2. What's the total experience and max salary by department?

# 3. Add a column showing each employee's salary as a percentage of their department's total?Other Pandas Classes

A DataFrame is essentially an annotated 2-D array.

Pandas also has annotated versions of 1-D and 3-D arrays.

A 1-D array in Pandas is called a Series. You can think of DataFrames as a dictionary of Series.

A 3-D array in Pandas is created using a MultiIndex.

For more information read the documentation.

In Class Activity

Iris Flower Analysis with Pandas

Duration: 20-25 minutes | Teams: 3 students each

Dataset: Iris Flower Dataset

Download Instructions: The Iris dataset is built into seaborn, so no download needed!

import pandas as pd

import seaborn as sns

# Load the Iris dataset directly

iris = sns.load_dataset('iris')Team Roles (2 minutes)

- Data Loader: Loads data and explores structure

- Data Analyzer: Performs calculations and filtering

- Data Visualizer: Creates plots and charts

Activity Tasks (20 minutes)

Phase 1: Data Loading & Exploration (5 minutes) 1. Check the shape and column names 2. Use .head(), .info(), and .describe() to explore the data

# Replace 0 and '[]' with the correct methods on iris

print(f"Dataset shape: {0}")

print(f"Columns: {['']}")

# Look at the first few rows

print("First 5 rows:")

# Get basic info about the dataset

print("\nDataset Info:")

# Describe the dataset with summary statistics

print("\nSummary Statistics:")Phase 2: Basic Data Manipulation (8 minutes) 1. Create new columns: - Add a ‘petal_area’ column (petal_length × petal_width) - Create a ‘sepal_area’ column (sepal_length × sepal_width) - Create a ‘size_category’ column: - ‘Small’ (petal_area < 2) - ‘Medium’ (petal_area 2-5) - ‘Large’ (petal_area > 5)

# Create petal area column

iris['petal_area'] = ...

# Create sepal area column

iris['sepal_area'] = ...

# Create size category column

def categorize_size(petal_area):

if ... :

return 'Small'

elif ... :

return 'Medium'

else:

return 'Large'

iris['size_category'] = ...

print("New columns created:")

print(iris[['petal_length', 'petal_width', 'petal_area', 'size_category']].head(10))- Data Filtering:

- Find all ‘setosa’ species flowers

- Filter for large flowers only

- Find flowers with sepal_length > 6

# Find all 'setosa' species flowers

setosa_flowers = ...

print(f"Setosa flowers: {len(setosa_flowers)} out of {len(iris)}")

# Filter for large flowers only

large_flowers = ...

print(f"Large flowers: {len(large_flowers)} out of {len(iris)}")

# Find flowers with sepal_length > 6

long_sepal = ...

print(f"Flowers with sepal_length > 6: {len(long_sepal)} out of {len(iris)}")- Basic Analysis:

- Count flowers by species

- Find average petal length by species

# Count flowers by species

species_counts = ...

print("Flowers by species:")

print(species_counts)

# Find average petal length by species

avg_petal_by_species = ...

print("\nAverage petal length by species:")

print(avg_petal_by_species)Phase 3: Simple Visualizations (7 minutes) 1. Create 2-3 basic plots: - Histogram of petal length - Bar chart of flower count by species - Scatter plot: sepal_length vs sepal_width

# Create a figure with subplots

fig, axes = plt.subplots(2, 2, figsize=(15, 10))

# 1. Histogram of petal length

axes[0, 0].hist(iris['petal_length'], bins=15, alpha=0.7, edgecolor='black', color='skyblue')

axes[0, 0].set_title('Distribution of Petal Length')

axes[0, 0].set_xlabel('Petal Length (cm)')

axes[0, 0].set_ylabel('Frequency')

axes[0, 0].grid(True, alpha=0.3)

# 2. Bar chart of flower count by species

species_counts = iris['species'].value_counts()

species_counts.plot(kind='bar', ax=axes[0, 1], color=['red', 'green', 'blue'])

axes[0, 1].set_title('Number of Flowers by Species')

axes[0, 1].set_xlabel('Species')

axes[0, 1].set_ylabel('Number of Flowers')

axes[0, 1].tick_params(axis='x', rotation=45)

axes[0, 1].grid(True, alpha=0.3)

# 3. Scatter plot: sepal_length vs sepal_width

for species in iris['species'].unique():

data = iris[iris['species'] == species]

axes[1, 0].scatter(data['sepal_length'], data['sepal_width'],

alpha=0.7, label=species, s=50)

axes[1, 0].set_title('Sepal Length vs Sepal Width (by Species)')

axes[1, 0].set_xlabel('Sepal Length (cm)')

axes[1, 0].set_ylabel('Sepal Width (cm)')

axes[1, 0].legend()

axes[1, 0].grid(True, alpha=0.3)

# 4. Bar chart of size categories (if size_category column exists)

if 'size_category' in iris.columns:

size_categories = iris['size_category'].value_counts()

size_categories.plot(kind='bar', ax=axes[1, 1], color=['orange', 'lightgreen', 'lightcoral'])

axes[1, 1].set_title('Flowers by Size Category')

axes[1, 1].set_xlabel('Size Category')

axes[1, 1].set_ylabel('Number of Flowers')

axes[1, 1].tick_params(axis='x', rotation=0)

axes[1, 1].grid(True, alpha=0.3)

else:

# Alternative: petal length vs petal width scatter

axes[1, 1].scatter(iris['petal_length'], iris['petal_width'], alpha=0.7, s=50)

axes[1, 1].set_title('Petal Length vs Petal Width')

axes[1, 1].set_xlabel('Petal Length (cm)')

axes[1, 1].set_ylabel('Petal Width (cm)')

axes[1, 1].grid(True, alpha=0.3)

plt.tight_layout()

plt.show()Upon Completion:

Execute all the cells, save and download the notebook and submit to Gradescope.

Recap

In this section we got a first glimpse of the Pandas library.

We learned how to:

- load data from a CSV file

- inspect the data

- manipulate the data

- plot the data

- access rows and columns of the dataframe

- filter the data

- create new columns

- group the data